Unless you have the financial resources to do it all on your own, an entrepreneur at any age is going to have to face the daunting task of fundraising at some point in the start-up journey.

For QIVIUT & CO that time is now as we seek a seed round (i.e., first stage) of outside funding to take our project to the next level of development. In our case, the funds will be used primarily to acquire additional musk ox fibre for new products and to significantly ramp up our marketing so as to make our story much less of a well kept secret. For other start-ups it could be to fund a proof of concept effort, expand a proven concept, or develop a proprietary technology (where the lion’s share of investor interest is at the moment).

The good news is that access to capital for start-ups is probably as good as it has ever been with multiple sources of potential investment available to entrepreneurs. Gone are the days when friends and family and bank loans (always a tough option for start-ups) were pretty much it. Nowadays, there are government assistance programs to encourage innovation, angel investors, venture capital and private equity firms, peer to peer lending, equity crowdfunding and the list goes on.

The bad news is that with ease of access to potential funding comes an abundance of demand. In an era when seemingly everyone wants to be an entrepreneur, competition for funds is fierce and the time investors devote to reviewing funding proposals is diminished.

So how is it done? I don’t pretend to be an expert but I have raised funds a few times in my entrepreneurial career and am far enough along in our current fundraise to provide some basic insights that may be of value to those embarking on the same effort.

What’s The The Big Idea?

Probably a better question than how is it done is why are you doing it and, more specifically, why are you doing it now ? I don’t mean why are you raising funds but why are you doing your project in the first place and why is your timing right? The best answer, of course, is that you think you have found a way to build a better mousetrap, something that is more efficient, less costly, better tasting, faster, easier, etc. You have found a void in the market you think you can fill or disrupt with a new product or service. Or you are solving a problem, even one that may not be obvious.

“If I had asked people what they wanted they would have said faster horses.”

Henry Ford

The point is that you need to have a USP that will quickly resonate with investors. That is why the tech sector is so hot now. Applying 21st century technology, be it an app, artificial intelligence, robotics, 3D printing or whatever, to solve an “old” problem makes it much easier to quickly grab the attention of a potential investor than pitching for a new fashion start-up whose only differentiator is the “fantastic” designs of the founder.

Our raise in the fashion sector is a bit unique in that QIVIUT & CO is not a designer led fashion brand. For us, it is all about the never before commercialised fibre on which our brand is based.

Our USP is bringing to market for the first time a natural fibre that can disrupt the status quo of the luxury fashion sector by being “the new cashmere” with superior performance for warmth and hand feel while offering legitimate exclusivity due to scarcity, particularly as cashmere becomes more and more commoditised with widely varying degrees of quality in the marketplace.

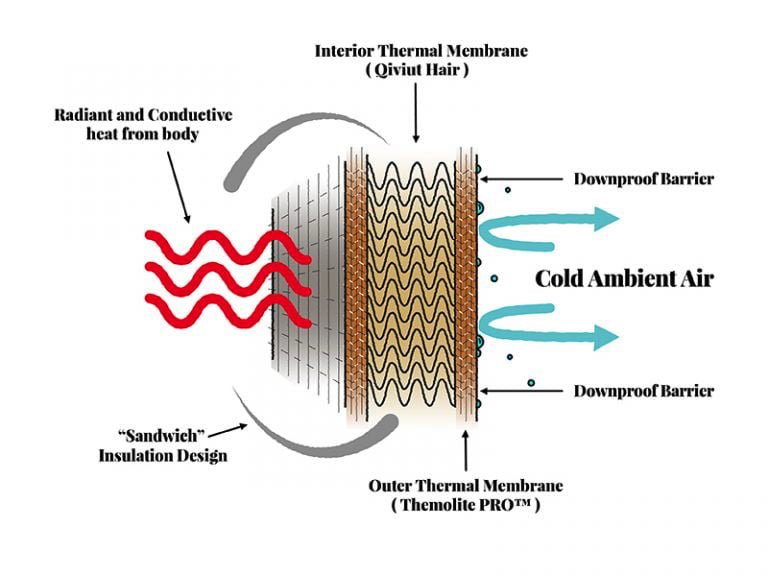

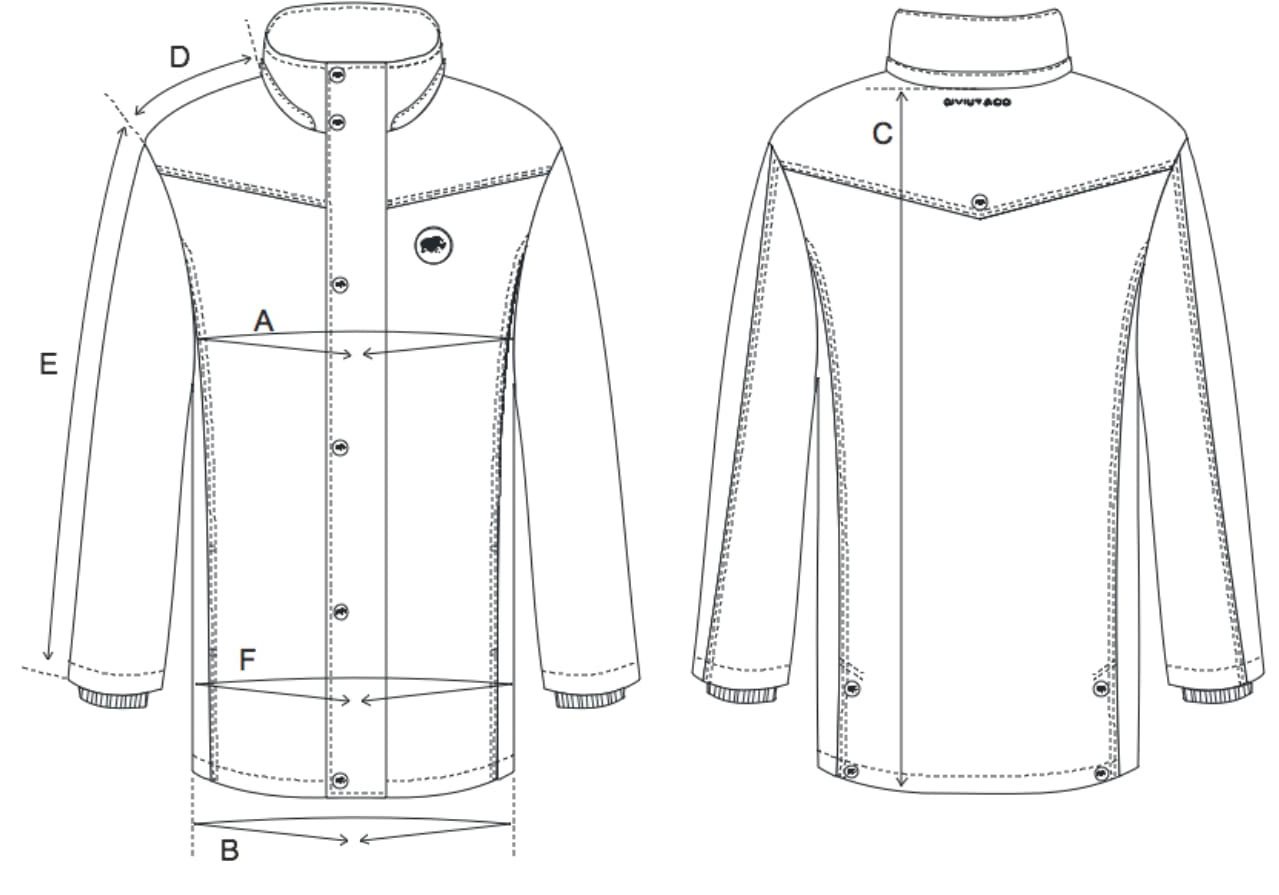

In addition, the outstanding thermal capability of musk ox fibre prompted our development of the technology for the slim profile insulation used for our flagship product, The Qiviut Jacket, as an alternative to the bulky feathers and down currently used by almost all luxury outerwear manufacturers. (Read: no Michelin Man look.)

This offers the additional benefit of a separate business to business revenue stream by marketing our insulation to the trade. Potential investors ask, of course, how our insulation compares to goose down. In response, I could refer to the favourable laboratory test results cited in our business plan but prefer to just point out that musk ox survived the Ice Age

and don’t fly south for the winter. Q.E.D.

This is our big idea but every funding proposal needs one and, ideally, one that can be described in a single sentence or less.

How Big Is The Big Idea?

Even the greatest idea is only fundable if it is addressing a market of sufficient size to make it worth pursuing. You may have developed the best mousetrap rodent tech can devise but if there just aren’t that many mice to be caught it probably won’t get funded. Different types of investors require different types of returns but they all want to be convinced of your ability to penetrate a market of sufficient size. Therefore, it is important to define that market as precisely as possible and explain exactly how you will gain share.

As a direct to consumer luxury brand the market we are targeting is global online luxury apparel, predicted by Bain & Co. to be worth €11BN in 2020 with penetration achieved by use of traditional and non-traditional marketing and by expanding into new clothing categories along with a separate wholesale revenue stream selling musk ox fibre fabric and insulation to the trade.

On this point, it can be helpful to cite comparable companies who have achieved success doing something similar to the business seeking funding. An investor will understand that his does not guaranty copycat success but it does help to validate your premise. To support our premise I like to cite four examples:

For outerwear:

Moncler – Taken public in 2013 and with sales exceeding €1BN in 2017.

Canada Goose – Taken public in 2017 with revenues of CDN$591 for FY18.

For cashmere:

Loro Piana – sold 80% to LVMH for €2BN in 2013 with sales of €700M.

Brunello Cucinelli – Taken public in 2012 with revenues of €503M in 2017.

Obviously, it takes a lot more than a round of seed funding to achieve these kinds of successes and the flip side of such precedents is that some investors will be leery of how an upstart can acquire market share from such entrenched legacy brands with much deeper pockets. It is a legitimate concern responded to in large measure by how much a challenger can differentiate itself from such brands. There is a reason Apple encouraged personal computer shoppers to “Think different”.

For us, it all hinges on the extent to which an investor believes in musk ox fibre being able to challenge as a differentiator the established brands selling outerwear and cashmere products.

If we can, the above examples offer some kind of indication as to what can be achieved with proper execution.

And Speaking Of Execution…

Once the viability of a big idea has been validated and a sufficient target market defined, the critical next step is to demonstrate how it will all happen. For some projects this will mean detailing the plan to go from concept to operational. For others already up and running it will mean presenting a blueprint for growth. As a very general statement, most investors prefer to fund the latter. If you have already achieved some traction and can show market acceptance of your product or service, that lessens the risk compared to something that is just an idea.

For this reason, we did not attempt to fundraise until we had created a minimally viable product line and had a decent amount of trading experience under our belt so as to establish our development credibility and the market acceptance for our products. However, others may be able to fundraise with nothing more than a concept or prototype. In either case what will be most important to investors is the quality of the team assembled to turn a start-up into a fully functioning business.

This is a core group of people, usually 1-4, who possess the experience and expertise to instill confidence in investors that they can develop the project as touted or when it doesn’t go to plan (as most certainly will happen in some measure), has the ability to recognise, recover and adapt.

This is a core group of people, usually 1-4, who possess the experience and expertise to instill confidence in investors that they can develop the project as touted or when it doesn’t go to plan (as most certainly will happen in some measure), has the ability to recognise, recover and adapt.

The three-person start-up team for QIVIUT & CO is somewhat older than most but as such possesses a good mixture of extensive start-up experience, clothing production expertise and luxury brand development capability. Notice that I did not mention fashion design talent as that has been acquired on a contract basis to date (but will become a team position post-funding).

Customers and Competitors

While I previously addressed the need to identify a start-up’s target market, equally important to ensuring execution success is a very clear understanding of the target customer within that market and market positioning in general.

The former impacts everything from brand image to product or service design to marketing strategy. For this reason, we established multiple user profiles early on in our start-up journey and after more than eighteen months of trading they have matched up almost exactly with our real-life experience.

Market positioning defines who you regard as competition and where your brand fits in the marketplace among those competitors. This will also inform how you craft your brand image and define and convey your competitive advantage(s).

For QIVIUT & CO positioning is based on the advantages of performance and exclusivity.

We know from laboratory testing that our fibre outperforms any other fur or feather on a like for like basis in terms of thermal performance (but see my previous thoughts on warmth). We also know that based upon the extreme fineness of musk ox qiviut fibre (Average Fibre Diameter: 11-17 microns), it has a hand feel softness equal to or better than cashmere (AFD: 15-22 microns) or any other natural fibre. Finally, musk ox fibre is legitimately exclusive because of its scarcity and difficulty to source. However, there are legacy luxury brands that maintain the image of greater exclusivity based solely on price and/or artificially restricted production.

Do’s and Don’t’s

So, these are the very basics that investors will want to see in a funding proposal. I have not addressed in this primer the more sophisticated elements required for equity fundraising: valuation, cap table, performance metrics, shareholder agreement, etc. but all of these are equally important and may be the subject of a future blog.

However, I can provide a few concluding do’s and don’t’s. Here are some other things to keep in mind when fundraising:

Fundraising Do’s

Personalise your pitch. Think of fundraising as an investor recruitment process, not as asking for money. Research potential investors as much as they will most certainly be researching you.

Try to present through the mindset of the investor, not your own. Angels and VCs will have different approaches to an investment.

What have been their successful investments and how might your project mirror that experience for them? What have been their failures and how will you avoid those pitfalls? The best investors provide expertise as well as money.

In the event of a funding offer, carefully consider the personal chemistry you may or may not have with the investor. A founder-investor relationship is much like a marriage and usually long term. Make sure that you and your investor(s) share the same values and vision for the business, respect each other’s opinions and, ideally, enjoy each other’s company. Many a start-up has failed (or founder been ousted) because the personal relationship did not work.

Know your data cold, market size, KPIs, margins, all of it. It’s like the tourist in NYC who asked a street performer playing a violin how to get to Carnegie Hall and received the answer “Practice, practice”. Rehearse your pitch until you think you have it down pat – and then rehearse some more.

Expect rejection and a lot of it. Investors are pre-conditioned to say “no”. But ask why and learn from the experience. And don’t be afraid to solicit suggestions of other investors to contact. Different investors have different interests and investment criteria. They also often talk to each other so a “no” from one could lead to a “yes” from another.

Always send a post-pitch thank you even when rejected.

And Dont’s

Show up late for a pitch. That can be a deal killer in and of itself.

Claim that no one else is doing what you are doing or that you have no competitors or that your competitors are too unaware/uncaring/bureaucratic to be a threat. That may sound nice in theory but most investors know such claims are rarely true in fact and can come across as arrogant.

Claim that a patent or trademark makes your product or service unassailable. This is not to dispute that intellectual property is good and of value but enforcing the infringement of it is another story. Just ask the luxury clothing and accessory brands that still have not figured out how to prevent counterfeiting.

Expect quick results which is the counterpart to expecting rejection. Unless you are incredibly lucky, fundraising is a long, hard slog. Depending upon how much you are trying to raise and from whom, most fund-raising veterans will tell you to allow six months to a year to complete a round (although crowdfunding can be done more quickly in many cases).

Undoubtedly, I will have some further thoughts on fundraising once we complete our seed round. I am sure there are many things I do not know and will find out the hard way.

But like everything else in this project, there is value in the experience regardless of the result. Accordingly and as difficult as fundraising may be, I look forward to enjoying the journey.

Carpe Argentum!

Dear Bob

A very good read: interesting and informative. I suppose it’s OK for an ivy league American to include some Latin, but I’m less sure about a spit infinitive, although I believe your current President uses them quite a lot!

Good luck with the fundraising.

Hugh,

Thanks for the Latin grammar lesson. I guess I should have paid closer attention in class for which reason I will stick with the Queen’s English for my pitches.

Bob

Bob Gould

I traveled to Croatia in late February ( brrrr ) and wore my Qiviut Jacket every day. We were on an O.A.T. Tour with 50 other vacationers, all bundled up from top to bottom, but none as warm and comfy as I. I’m sure you have now heard from many of them. Just about everyone asked who made it and I could only say to check the website out. My apologies for the split infinitive. That man who offered the comment must be a Scotsman.

Kathy Rose

Kathy,

Very nice of you to comment. I am glad The Qiviut Jacket performed as advertised for you. It really is an amazing fibre. Now the challenge is just getting the world to know about it. That will happen with funding. For the moment, we remain an online only direct to consumer brand. That is how we can best control the story, manage our limited inventory and provide value without middlemen mark-ups.

As for the nationality of my Latin critic, I won’t hazard a guess lest I split more than just infinitives.

Bob